DOTmed Industry Sector Report: RF Shielding

February 10, 2010

by Kathy Mahdoubi, Senior Correspondent

This report originally appeared in the January 2010 issue of DOTmed Business News.

When it comes to magnetic resonance imaging, MRI scanners get all the attention, but a lot more goes into the finished MRI suite. Radio-frequency and magnetic shielding both contain and keep out forms of energy that can, if not dealt with properly, cause serious problems with image quality and, depending upon the strength of the magnet, a very real safety hazard. While the current dismal U.S. economy has dampened new-unit MR sales, RF shielding companies are seeing more international expansion and are getting creative stateside by developing the service aspect of their business as testing, upgrades, modifications and repair become the name of the game.

The largest market share for RF shielding is currently held by ETS-Lindgren, headquartered in Cedar Park, Texas. The company identifies, measures and provides solutions to contain and control magnetic, electromagnetic and acoustic energy and provides RF and magnetic shielding across the country and throughout the world. Approximately 32 percent of ETS-Lindgren's business is medical, with about 8,000 medical installations already on the books.

"In 2008, we had about $155 million in orders and $144 million in sales," says William Giacone III, RF shielding division vice president and general manager of Lindgren RF Enclosures, Inc. "In 2009 we will be down just a few percent lower in both areas. The economy has been tough on us, but not horrible."

Ben Turner, ETS-Lindgren's vice president of sales and marketing, says demand for RF shielding has not been increasing. Instead, companies like ETS are striving to grow their business by increasing market share.

The company also remains stable with the help of its diverse portfolio. When medical is down, industrial or wireless testing may be up. "On the government industrial side of the RF Shielding business, we work with the Department of State, the FBI, Army, Air Force, you name it," says Giacone.

Another company moving up in the U.S. is IMEDCO America, a division of IMEDCO AG, based in Switzerland. About 5,000 installations worldwide have put them in a strong second.

"We're number two worldwide in RF shielding and growing our percentage," says Michael Krachon, IMEDCO America director and general manager. "It's the international presence that's allowed us to build our U.S. market."

Despite the economy, some players are moving up and experiencing strong growth in their RF shielding business. Magnetic Resonance Technologies, Inc., out of Willoughby, Ohio, has doubled their sales in 2009. "We are logged to be on the same growth path for 2010," says Michael Profeta, president of the company.

National MRI Shielding, Inc., out of Dallas, Texas, has also been seeing a good share of business this year, says owner Cliff Hess. "Business has actually been up this year, but I don't think that's an indication of the industry in general," says Hess. "What I hear from other companies is that business is down and bigger companies have been laying people off."

Laurie Jacobs is president of Medishield, Inc., based in New Albany, Ind. She says her business has felt the pinch of health care reform. "We have been pretty slow. I think a lot of hospitals are waiting on health care reform before they put in new systems, but in the past two months we've been picking up; quoting a lot more, bidding a lot more and getting more projects."

The Shift toward Service

MR Shielding companies are seeing far more surveying, repair, modifications and upgrades than ever before, and with capital budgets on hold and hospitals waiting to see what happens in Washington, it's going to be a strong trend in the coming year.

"There hasn't been as many new installs this year as there were in past years, which is an indication of the drop off in MRI sales," says Hess.

Hospitals and freestanding imaging centers are trying to hold the line and keep their equipment for the long haul, and upgrading instead of going for new fixed units.

"From what I gather the industry as a whole is really slow," says Mike Lahita, president of Shielding Resources Group, Inc. "With this economy, people are trying to work with what they have."

As hospitals hold onto older units, more RF Shielding companies are being contacted because artifacts are showing up on scans. A lot more focus is on troubleshooting and service. "There is a lot more out there than simply selling a shield," says Giacone.

There has also been a marked increase in used-system installations, says Bill Mansfield, owner of Professional Installations out of Cleveland, Ohio. "We're playing shuffle-the-magnets-around instead of doing new installs like we used to. New systems have simply dried up and used systems have tripled."

Going International

ETS-Lindgren retains manufacturing, sales and service offices throughout the world. The Americas account for about 64 percent of the company's business; Asia now holds about 23 percent and about 13 percent of their business is based in Europe. Asia may commandeer as much as 30 percent of the company's business over the next year or two, says Giacone.

Professional Installations has anchored three jobs in Mexico and projects in Greece, the Dominican Republic, Haiti, and three in India. "I've never been busier," said Mansfield. A lot of shielding is going up for 1.5 Tesla and open MRI scanners in developing countries. "In the U.S. it's about equal between high field and open systems."

Newcomers to the U.S.

IMEDCO America made the transition to the U.S. in the mid 1990s, but it has been a process, says Krachon. "Our first U.S. sale was in 1994, but it was not until the late '90s or early 2000s that we were really able to make a significant dent in this market. Domestic production positions us to be more competitive with pricing and lead times as all of our shielding competitors are based here in the US."

Other companies may be forced to lay off workers, but IMEDCO America's expansion and added manufacturing in the U.S. has led to a 20 percent increase in their personnel. Upgrades to higher field systems are occurring - not all hospitals and imaging centers are at an MR scanner stalemate.

"We have been able to hold the overall business steady due to the economies realized by local production," says Krachon. "There has also been an increase in services such as drawings and planning contracts, testing services and shield modifications due to the number of upgrades taking place to support newer and higher-field magnets."

High-Field projects

The strength of the magnet is a huge factor in determining what kind and how much shielding is required. In possibly the highest-profile install to date, ETS-Lindgren provided the shielding for the highest-field magnet on record for whole body MRI scans-the University of Illinois' 9.4 Tesla magnet in Chicago. This 57-ton magnet produces a magnetic field 100,000 stronger than the earth's magnetic field. For this project, shielding crews welded two to three-inch thick steel plates to create both an RF and magnetic shield.

"With a 9.4 Tesla magnet, there are a lot of shielding issues there," Giacone says. "We actually had to put 520 tons of steel plate around the magnet."

Back down in the 3 Tesla range, Hospitals that have budgeted for high-field upgrades should not only take RF shielding into account, but also magnetic shielding. "A lot of the new, higher-field magnets require magnetic shielding," says Jacobs. "[In these cases] RF and magnetic shielding go hand in hand."

Mike Lahita says there has been about a 50 percent increase in 3 Tesla systems during the past year or two. Another developing trend in shielding is with intra-operative MRI. ETS-Lindgren has six intra-operative MRI projects scheduled for 2010.

Shielding from Day one

Before shielding can be installed, there must first be a series of testing conducted to evaluate vibration, the electromagnetic interference and acoustic disturbance at the install site. The manufacturers' manual and site specifications have become holy scripts for tradesmen, as different machines can have very different site requirements. A series of site drawings are completed and discussion begins as the customer and the RF shielding vendor work out the optimal product and design.

"Properly planning the shield package is by far the most effective way to have that phase of the construction go smoothly," says Krachon. "The most effective way to achieve this is to assign a qualified project manager that can work with all parties so they can fully understand what is expected of them. This includes full disclosure of the site conditions, constant communication with engineering, contractor and architectural resources, including shield vendor resources. Once all is well defined, it is much more likely that a competent shielding vendor will have the proper materials and installation resources available to complete the installation on time and with minimal change notices."

Once drawings are approved, the manufacturing of the shielding gets underway. Materials vary slightly from vendor to vendor in terms of the thickness of the copper, steel, or aluminum and how it is fabricated. Once the shielding has been installed and the MRI scanner has been brought in through access panels in the enclosure, the access panels are then removed and final RF testing is completed and signed off by the customer.

Modular Versus Soldered Construction

These are the two major types of shielding designs. Modular is often a more affordable and versatile option, while soldered enclosures are a heavier and usually longer-lasting option. Both have their advantages and limitations.

"The customer needs to decide what type of shield he wants and if it is cost or quality driven. Not all shields are the same," says Profeta. "There are pros and cons with the different construction styles. Soldered copper shields are arguably the best method for quality and long-term reliability, provided the proper care is taken at all the penetrations. An owner needs to make an educated decision when selecting an RF room vendor and really needs to understand what they are buying and compare options. Dealing with the large shielding companies is not a guarantee that you are getting the best product for your project or money."

Mansfield says he runs into a higher failure rate with modular designs and that the long-term cost on soldered enclosures may end up being cheaper. "A lot of people are trying to stay alive, but they just don't understand how much maintenance goes into these modular rooms."

One benefit of the modular room is that it does not require a parent wall and may be the best option for hospitals that aren't planning to maintain an MRI for a long period of time. The advantage here is that you can take them down and move them quickly.

High-End Doors Now Becoming Standard

For the shielding industry the door is always a challenge. It's a delicate balance trying to maintain the integrity of the MR environment when people are constantly coming in and out.

"Pneumatic door systems allow easy door operation," says Turner. "Early concepts used gaskets. However, when a gasket fails the entire gasket must be replaced. Today, pneumatic cylinders provide greater reliability and easier servicing."

Shielding companies can also draw on each other's strengths. Mansfield says Professional Installations sells a lot of their high-end doors to competitors.

The Greatest Challenges to the Industry

The material and design involved in RF shielding has remained much the same with minimal modifications, but the education of customers and contractors is ongoing.

"Although there has been some improvement, there are still many bid packages that only partially describe the MR shielded enclosure," says Krachon. "This opens up areas of risk for the end-user since shielding suppliers are less likely to include important features unless they are called out in the specs."

Specifications pertaining to the structural integrity of RF and magnetic shielding and shield support, whether free-standing or connected to grids, and acoustic requirements are sometimes omitted from the plans and general contractors are left to interpret the situation on their own.

"Most GC's do not have time to do this, despite the potential affect it could have on overall construction costs," says Krachon.

Another challenge is maintaining the shield after construction is complete. A construction company might come in and work on the sprinkler or ventilation system and if they are not properly informed about MR shielding, they can throw off MR scans and force hospitals to troubleshoot their imaging woes while piling on the service costs.

"Our largest challenges are not shield install related, but rather dealing with the continued education of general contractors and architects on the 'how's and why's' to preserve the shielding integrity during the balance of construction after the shield is complete," says Profeta.

Yet another challenge is placement of the enclosure. It is typically easiest to outfit a hospital or imaging center when the MR is situated in the basement or first floor, but increasingly, MR scanners are going in on the upper floors to complement other departments, like the OR or nuclear medicine suite, and a host of new disturbances have to be accounted for.

Keeping up with maintenance is also an issue. Many sources indicate that neglect after installation is not that infrequent.

"Unfortunately, not many sites follow up with [shielding maintenance] after the install is complete and the image quality can suffer," says Profeta. "Most doors require regular maintenance to ensure ease of operation and a good RF seal. Yearly re-certification is recommended and may soon be required."

Stymied, but Not at a Stalemate

Shielding companies have had to get creative with their businesses as the kinds of products and services they provide have shifted with the dictates of the market, but there doesn't seem to be a lot of suffering.

"In general, bringing in new equipment has been stymied and delayed, but there's been a lot of desire to upgrade and no matter what is happening with the economy, there is going to be a certain interest in developing this technology."

As long as MRI systems emit energy that must be contained and as long as the world outside the MRI vault provides all the disturbance and interference of the modern world of technology, this industry will be relatively shielded from the financial upsets felt by other industries.

Not Just Shielding

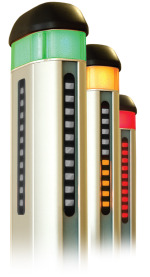

ETS-Lindgren has some other solutions for MR safety. The company's Ferroguard Beacon freestanding and wall-mounted warning system is comprised of two sensors positioned outside the MRI vault that sets off an alarm when ferrous material is about to be brought into the magnetic field. No more flying oxygen tanks and other metal accessories, or issues with metal implants not recorded in patients' medical histories. When approaching the poles, any materials that might be a safety hazard will set off a three-level visual alarm. Depending upon the risk involved, the Ferroguard Beacon will glow green, yellow or red. A red alarm is accompanied by an audible alarm. The American College of Radiology is now recommending the Ferroguard Beacon on all new installations. "This is an area of MR safety that is really going to ramp-up over the next couple of years. It's not getting into the headlines," says William Giacone III, vice president and general manager of Lindgren RF Enclosures, Inc.

The company also provides a technology that can actually counteract fluctuations in magnetic fields due to environmental interference. The Magnetic Active Compensation System (MACS) uses negative feedback technology and auto-adjusts as the environment changes using probes and sensors to gauge and counteract AC/DC magnetic interference and disturbances caused by traffic patterns, electrical transformers and elevators, which might otherwise create "zippers" and other artifacts on MR images.

DOTmed Registered RF Shielding Sales and Service Companies

Names in boldface are Premium Listings.

Domestic

Paul DeWinter, AEA Technology, Inc., CA

Donald McCormack, Southwest Medical Resources, CA

Tanner LoRusso, Sound Imaging, Inc., CA

Benjamin Turner, ETS-Lindgren, IL

Gary Knirr, Basic MRI Medical Systems, IL

Laurie Jacobs, Medishield, Inc., IN

Michael Krachon, IMEDCO America, Ltd., IN

Chaz Beadling, American X Ray Equipment Sales & Service, MD

Irwin Newman, Universal Shielding Corp., NY

William Mansfield, Professional Installations, OH

Michael Profeta, Magnetic Resonance Technologies, Inc., OH

DOTmed Certified

Tom Foyil, Braden Shielding Systems, OK

Mike Lahita, Shielding Resources Group, Inc., OK

Dustin Hess, National MRI Shielding, TX

Rusty Harper, Shielding Dynamics, Inc., TX

International

Horacio Jose Gomez, VCG Imagen SRL, Argentina

When it comes to magnetic resonance imaging, MRI scanners get all the attention, but a lot more goes into the finished MRI suite. Radio-frequency and magnetic shielding both contain and keep out forms of energy that can, if not dealt with properly, cause serious problems with image quality and, depending upon the strength of the magnet, a very real safety hazard. While the current dismal U.S. economy has dampened new-unit MR sales, RF shielding companies are seeing more international expansion and are getting creative stateside by developing the service aspect of their business as testing, upgrades, modifications and repair become the name of the game.

The largest market share for RF shielding is currently held by ETS-Lindgren, headquartered in Cedar Park, Texas. The company identifies, measures and provides solutions to contain and control magnetic, electromagnetic and acoustic energy and provides RF and magnetic shielding across the country and throughout the world. Approximately 32 percent of ETS-Lindgren's business is medical, with about 8,000 medical installations already on the books.

"In 2008, we had about $155 million in orders and $144 million in sales," says William Giacone III, RF shielding division vice president and general manager of Lindgren RF Enclosures, Inc. "In 2009 we will be down just a few percent lower in both areas. The economy has been tough on us, but not horrible."

Ben Turner, ETS-Lindgren's vice president of sales and marketing, says demand for RF shielding has not been increasing. Instead, companies like ETS are striving to grow their business by increasing market share.

The company also remains stable with the help of its diverse portfolio. When medical is down, industrial or wireless testing may be up. "On the government industrial side of the RF Shielding business, we work with the Department of State, the FBI, Army, Air Force, you name it," says Giacone.

A magnet entry opening in

a new RF shield installation in

Angleton, TX for Hitachi.

(Image courtesy of

Shielding Resources Group)

a new RF shield installation in

Angleton, TX for Hitachi.

(Image courtesy of

Shielding Resources Group)

Another company moving up in the U.S. is IMEDCO America, a division of IMEDCO AG, based in Switzerland. About 5,000 installations worldwide have put them in a strong second.

"We're number two worldwide in RF shielding and growing our percentage," says Michael Krachon, IMEDCO America director and general manager. "It's the international presence that's allowed us to build our U.S. market."

Despite the economy, some players are moving up and experiencing strong growth in their RF shielding business. Magnetic Resonance Technologies, Inc., out of Willoughby, Ohio, has doubled their sales in 2009. "We are logged to be on the same growth path for 2010," says Michael Profeta, president of the company.

National MRI Shielding, Inc., out of Dallas, Texas, has also been seeing a good share of business this year, says owner Cliff Hess. "Business has actually been up this year, but I don't think that's an indication of the industry in general," says Hess. "What I hear from other companies is that business is down and bigger companies have been laying people off."

Laurie Jacobs is president of Medishield, Inc., based in New Albany, Ind. She says her business has felt the pinch of health care reform. "We have been pretty slow. I think a lot of hospitals are waiting on health care reform before they put in new systems, but in the past two months we've been picking up; quoting a lot more, bidding a lot more and getting more projects."

The Shift toward Service

MR Shielding companies are seeing far more surveying, repair, modifications and upgrades than ever before, and with capital budgets on hold and hospitals waiting to see what happens in Washington, it's going to be a strong trend in the coming year.

"There hasn't been as many new installs this year as there were in past years, which is an indication of the drop off in MRI sales," says Hess.

Hospitals and freestanding imaging centers are trying to hold the line and keep their equipment for the long haul, and upgrading instead of going for new fixed units.

"From what I gather the industry as a whole is really slow," says Mike Lahita, president of Shielding Resources Group, Inc. "With this economy, people are trying to work with what they have."

As hospitals hold onto older units, more RF Shielding companies are being contacted because artifacts are showing up on scans. A lot more focus is on troubleshooting and service. "There is a lot more out there than simply selling a shield," says Giacone.

Three colored lights on the

Ferroguard® Beacon indicate

the imaging environment

(Image courtesy of ETS-Lindgren)

Ferroguard® Beacon indicate

the imaging environment

(Image courtesy of ETS-Lindgren)

There has also been a marked increase in used-system installations, says Bill Mansfield, owner of Professional Installations out of Cleveland, Ohio. "We're playing shuffle-the-magnets-around instead of doing new installs like we used to. New systems have simply dried up and used systems have tripled."

Going International

ETS-Lindgren retains manufacturing, sales and service offices throughout the world. The Americas account for about 64 percent of the company's business; Asia now holds about 23 percent and about 13 percent of their business is based in Europe. Asia may commandeer as much as 30 percent of the company's business over the next year or two, says Giacone.

Professional Installations has anchored three jobs in Mexico and projects in Greece, the Dominican Republic, Haiti, and three in India. "I've never been busier," said Mansfield. A lot of shielding is going up for 1.5 Tesla and open MRI scanners in developing countries. "In the U.S. it's about equal between high field and open systems."

Newcomers to the U.S.

IMEDCO America made the transition to the U.S. in the mid 1990s, but it has been a process, says Krachon. "Our first U.S. sale was in 1994, but it was not until the late '90s or early 2000s that we were really able to make a significant dent in this market. Domestic production positions us to be more competitive with pricing and lead times as all of our shielding competitors are based here in the US."

Other companies may be forced to lay off workers, but IMEDCO America's expansion and added manufacturing in the U.S. has led to a 20 percent increase in their personnel. Upgrades to higher field systems are occurring - not all hospitals and imaging centers are at an MR scanner stalemate.

"We have been able to hold the overall business steady due to the economies realized by local production," says Krachon. "There has also been an increase in services such as drawings and planning contracts, testing services and shield modifications due to the number of upgrades taking place to support newer and higher-field magnets."

High-Field projects

The strength of the magnet is a huge factor in determining what kind and how much shielding is required. In possibly the highest-profile install to date, ETS-Lindgren provided the shielding for the highest-field magnet on record for whole body MRI scans-the University of Illinois' 9.4 Tesla magnet in Chicago. This 57-ton magnet produces a magnetic field 100,000 stronger than the earth's magnetic field. For this project, shielding crews welded two to three-inch thick steel plates to create both an RF and magnetic shield.

"With a 9.4 Tesla magnet, there are a lot of shielding issues there," Giacone says. "We actually had to put 520 tons of steel plate around the magnet."

Back down in the 3 Tesla range, Hospitals that have budgeted for high-field upgrades should not only take RF shielding into account, but also magnetic shielding. "A lot of the new, higher-field magnets require magnetic shielding," says Jacobs. "[In these cases] RF and magnetic shielding go hand in hand."

Mike Lahita says there has been about a 50 percent increase in 3 Tesla systems during the past year or two. Another developing trend in shielding is with intra-operative MRI. ETS-Lindgren has six intra-operative MRI projects scheduled for 2010.

Shielding from Day one

Before shielding can be installed, there must first be a series of testing conducted to evaluate vibration, the electromagnetic interference and acoustic disturbance at the install site. The manufacturers' manual and site specifications have become holy scripts for tradesmen, as different machines can have very different site requirements. A series of site drawings are completed and discussion begins as the customer and the RF shielding vendor work out the optimal product and design.

"Properly planning the shield package is by far the most effective way to have that phase of the construction go smoothly," says Krachon. "The most effective way to achieve this is to assign a qualified project manager that can work with all parties so they can fully understand what is expected of them. This includes full disclosure of the site conditions, constant communication with engineering, contractor and architectural resources, including shield vendor resources. Once all is well defined, it is much more likely that a competent shielding vendor will have the proper materials and installation resources available to complete the installation on time and with minimal change notices."

Once drawings are approved, the manufacturing of the shielding gets underway. Materials vary slightly from vendor to vendor in terms of the thickness of the copper, steel, or aluminum and how it is fabricated. Once the shielding has been installed and the MRI scanner has been brought in through access panels in the enclosure, the access panels are then removed and final RF testing is completed and signed off by the customer.

Modular Versus Soldered Construction

These are the two major types of shielding designs. Modular is often a more affordable and versatile option, while soldered enclosures are a heavier and usually longer-lasting option. Both have their advantages and limitations.

"The customer needs to decide what type of shield he wants and if it is cost or quality driven. Not all shields are the same," says Profeta. "There are pros and cons with the different construction styles. Soldered copper shields are arguably the best method for quality and long-term reliability, provided the proper care is taken at all the penetrations. An owner needs to make an educated decision when selecting an RF room vendor and really needs to understand what they are buying and compare options. Dealing with the large shielding companies is not a guarantee that you are getting the best product for your project or money."

Mansfield says he runs into a higher failure rate with modular designs and that the long-term cost on soldered enclosures may end up being cheaper. "A lot of people are trying to stay alive, but they just don't understand how much maintenance goes into these modular rooms."

One benefit of the modular room is that it does not require a parent wall and may be the best option for hospitals that aren't planning to maintain an MRI for a long period of time. The advantage here is that you can take them down and move them quickly.

High-End Doors Now Becoming Standard

For the shielding industry the door is always a challenge. It's a delicate balance trying to maintain the integrity of the MR environment when people are constantly coming in and out.

"Pneumatic door systems allow easy door operation," says Turner. "Early concepts used gaskets. However, when a gasket fails the entire gasket must be replaced. Today, pneumatic cylinders provide greater reliability and easier servicing."

Shielding companies can also draw on each other's strengths. Mansfield says Professional Installations sells a lot of their high-end doors to competitors.

The Greatest Challenges to the Industry

The material and design involved in RF shielding has remained much the same with minimal modifications, but the education of customers and contractors is ongoing.

"Although there has been some improvement, there are still many bid packages that only partially describe the MR shielded enclosure," says Krachon. "This opens up areas of risk for the end-user since shielding suppliers are less likely to include important features unless they are called out in the specs."

Specifications pertaining to the structural integrity of RF and magnetic shielding and shield support, whether free-standing or connected to grids, and acoustic requirements are sometimes omitted from the plans and general contractors are left to interpret the situation on their own.

"Most GC's do not have time to do this, despite the potential affect it could have on overall construction costs," says Krachon.

Another challenge is maintaining the shield after construction is complete. A construction company might come in and work on the sprinkler or ventilation system and if they are not properly informed about MR shielding, they can throw off MR scans and force hospitals to troubleshoot their imaging woes while piling on the service costs.

"Our largest challenges are not shield install related, but rather dealing with the continued education of general contractors and architects on the 'how's and why's' to preserve the shielding integrity during the balance of construction after the shield is complete," says Profeta.

Yet another challenge is placement of the enclosure. It is typically easiest to outfit a hospital or imaging center when the MR is situated in the basement or first floor, but increasingly, MR scanners are going in on the upper floors to complement other departments, like the OR or nuclear medicine suite, and a host of new disturbances have to be accounted for.

Keeping up with maintenance is also an issue. Many sources indicate that neglect after installation is not that infrequent.

"Unfortunately, not many sites follow up with [shielding maintenance] after the install is complete and the image quality can suffer," says Profeta. "Most doors require regular maintenance to ensure ease of operation and a good RF seal. Yearly re-certification is recommended and may soon be required."

Stymied, but Not at a Stalemate

Shielding companies have had to get creative with their businesses as the kinds of products and services they provide have shifted with the dictates of the market, but there doesn't seem to be a lot of suffering.

"In general, bringing in new equipment has been stymied and delayed, but there's been a lot of desire to upgrade and no matter what is happening with the economy, there is going to be a certain interest in developing this technology."

As long as MRI systems emit energy that must be contained and as long as the world outside the MRI vault provides all the disturbance and interference of the modern world of technology, this industry will be relatively shielded from the financial upsets felt by other industries.

Not Just Shielding

ETS-Lindgren has some other solutions for MR safety. The company's Ferroguard Beacon freestanding and wall-mounted warning system is comprised of two sensors positioned outside the MRI vault that sets off an alarm when ferrous material is about to be brought into the magnetic field. No more flying oxygen tanks and other metal accessories, or issues with metal implants not recorded in patients' medical histories. When approaching the poles, any materials that might be a safety hazard will set off a three-level visual alarm. Depending upon the risk involved, the Ferroguard Beacon will glow green, yellow or red. A red alarm is accompanied by an audible alarm. The American College of Radiology is now recommending the Ferroguard Beacon on all new installations. "This is an area of MR safety that is really going to ramp-up over the next couple of years. It's not getting into the headlines," says William Giacone III, vice president and general manager of Lindgren RF Enclosures, Inc.

The company also provides a technology that can actually counteract fluctuations in magnetic fields due to environmental interference. The Magnetic Active Compensation System (MACS) uses negative feedback technology and auto-adjusts as the environment changes using probes and sensors to gauge and counteract AC/DC magnetic interference and disturbances caused by traffic patterns, electrical transformers and elevators, which might otherwise create "zippers" and other artifacts on MR images.

DOTmed Registered RF Shielding Sales and Service Companies

Names in boldface are Premium Listings.

Domestic

Paul DeWinter, AEA Technology, Inc., CA

Donald McCormack, Southwest Medical Resources, CA

Tanner LoRusso, Sound Imaging, Inc., CA

Benjamin Turner, ETS-Lindgren, IL

Gary Knirr, Basic MRI Medical Systems, IL

Laurie Jacobs, Medishield, Inc., IN

Michael Krachon, IMEDCO America, Ltd., IN

Chaz Beadling, American X Ray Equipment Sales & Service, MD

Irwin Newman, Universal Shielding Corp., NY

William Mansfield, Professional Installations, OH

Michael Profeta, Magnetic Resonance Technologies, Inc., OH

DOTmed Certified

Tom Foyil, Braden Shielding Systems, OK

Mike Lahita, Shielding Resources Group, Inc., OK

Dustin Hess, National MRI Shielding, TX

Rusty Harper, Shielding Dynamics, Inc., TX

International

Horacio Jose Gomez, VCG Imagen SRL, Argentina