Health reform not as predicted: How self-insured health plans can sustain coverage

May 15, 2023

By Christine Cooperand Jack Towarnicky

Health Reform, also known as the Affordable Care Act (ACA), is the government’s approach to access to health coverage. Enacted in March 2010, the ACA’s primary intent remains one of using federal and state mandates to make health insurance coverage affordable and available for individuals. It was not designed to reduce the cost of employer-sponsored coverage for employers, or employees.

Most Americans heard many predictions about how the “Affordable Care Act” would improve health coverage, including:

• If you like your doctor, you can keep your doctor

• If you like your health plan, you can keep your health plan

• The cost of coverage for a family will decline by $2,500 a year

• Health Reform won’t add one thin dime to the deficit

More about those promises later.

Most Americans never knew that Health Reform’s #1 goal wasn’t any of the above. In actuality, Health Reform’s #1 goal was always to reduce the number of uninsured.

Health Reform accomplished that goal by expanding access to taxpayer-subsidized coverage through expanded eligibility for taxpayer-paid Medicaid coverage and taxpayer-subsidized marketplace/exchange coverage. Having someone else pay the cost of health coverage became a deal many lower income Americans couldn’t refuse. The percentage of non-elderly Americans who are uninsured has declined from 18.2% (48.2 million) in 2010, to 7% (~28 million) in 2023. Medicaid enrollment increased 3.8% per year (68%) from 54MM (2010) to 88+MM (2022) due to Health Reform’s liberalized access and the COVID response.

Health Reform also added taxpayer-subsidized public exchange coverage where enrollment grew from 0 to 14+MM. Of that 14+MM, ~90% receive taxpayer subsidies. In other words, the cost of marketplace/exchange coverage continues to be unaffordable for most Americans who do not qualify for taxpayer subsidies.

Not as predicted: A decade later: Inflation and recession challenge affordable healthcare

When it comes to employer-sponsored coverage, Health Reform’s #1 goal was to mandate certain, mostly smaller employers offer coverage, and to improve the coverage all employers offered – no matter who got stuck with the increased costs. Since 2015, employers with 50+ employees are required to offer “affordable”, “minimum essential coverage” of “minimum value” or pay a penalty tax. Since 2010, employer-sponsored coverage must cover children up to age 26 regardless of dependency. And employer-sponsored coverage can no longer limit liability using annual or lifetime benefit maximums.

Because of the recent surge in general inflation, Americans are now paying more for healthcare coverage and services than ever before. And, because wages haven’t kept up with inflation, many have become “financially fragile” – unprepared for regular expenses, let alone out-of-pocket medical costs. The economic slowdown, and looming potential recession, is also forcing employers to pare back on benefits before restoring to layoffs and terminations.

As healthcare inflation continues in 2023, medical providers are increasing their fees to maintain revenues. This financially affects most employers and plan participants who can expect to pay more for provider services and health coverage, as well as paying for the subsidy of other’s healthcare coverage through the Health Insurance Marketplace.

As all stakeholders, including patients, providers and payers, are looking towards “what’s next,” many are encountering volatile economic conditions, labor issues, and government health policies to sustain cost-effective health coverage, despite the mechanisms of Health Reform.

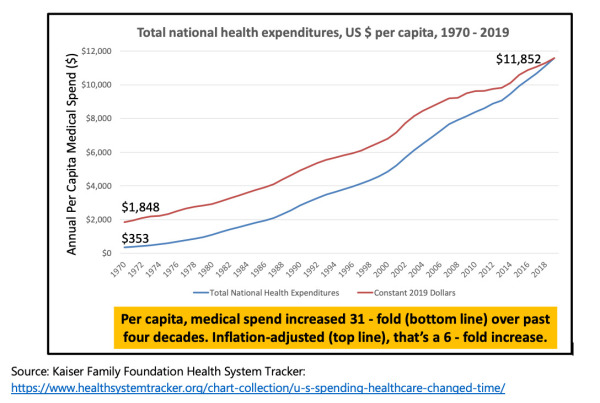

Ordinarily, the past is not a good predictor of the future. However, when it comes to employer-sponsored health coverage, the future, “what’s next”, looks like a repeat of the past, if not worse. Consider the following chart – it shows that costs have increased at a greater rate since 2010 – when Health Reform became law:

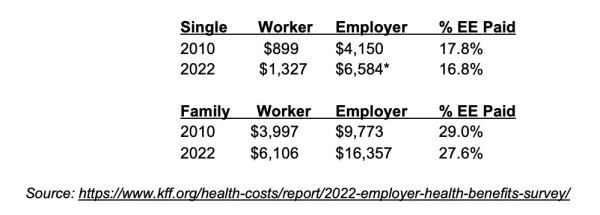

Data from the annual Kaiser survey shows that, during the twelve years after Health Reform worker contributions for single coverage have increased 3.3% per year while family coverage costs increased 3.6% per year. For comparison, employer-paid costs increased 4% per year, single and 4.4% per year, family.

This data shows that employers continue to shoulder more of the burden of health care inflation.

The average costs for U.S. employers that pay for their employees' healthcare now exceeds $13,800 per employee, according to professional services firm Aon. Aon and other benefit consulting firms project a future of ever-increasing rates for those covered under employer-sponsored plans.

We have yet to see the full impact of recent inflation on health care prices. How those increases, and continued deficit spending, will ripple through the economy is unknowable at this time. Suffice to say that health care costs will not decline in 2024.

Not as predicted: The future of employer-sponsored coverage after health reform

Long ago, two of the architects of Health Reform predicted that employer-sponsored health coverage would decline significantly by 2025 (two years from now):

• “By 2025, few private-sector employers will still be providing health insurance,” declares Ezekiel J. Emanuel, author of Reinventing American Health Care (Public Affairs, 2014) and advisor to the Obama administration during the drafting of the ACA.

• “The very likely prediction over the near term is that slight erosion continues in employer-sponsored insurance, over a longer term—say, a 25- to 50-year horizon—only the biggest employers may be still in the game.” says Jonathan Gruber, Massachusetts Institute of Technology economics professor who helped craft the ACA.

However, like the other predictions (keep your doctor, keep your plan, reduce costs, avoid deficit spending), the experts and proponents of Health Reform have been wrong. Employer-sponsored health benefits have persisted.

A study by the Employee Benefit Research Institute (EBRI) and the Commonwealth Fund, What Employers Say About the Future of Employer-Sponsored Health Insurance, identifies the conditions that might lead employers to stop providing health benefits. Study findings revealed that employers often view themselves as paternalistic: they wish to make it easier for their workers to get affordable health coverage. Accordingly, those interviewed found it difficult to imagine future circumstances that would lead their companies to stop providing health coverage. However, should we see additional policy initiatives, such as the extension of ACA subsidies and the provision of a public option, employers may reconsider their practice of offering health benefits to their workers.

Not as predicted: Health reform impacts annual deficits and national debt

Since the passage of Health Reform, annual deficits have added $19T+ to the national debt. America is now $31T+ in debt, in addition to significant underfunding of entitlements like Social Security and Medicare. We know of no estimate that isolated the impact of Health Reform on annual deficits and additions to the national debt. However, post-pandemic, federal government health care spending is now $1.9T a year, almost $1 of every $3 of federal spending. For comparison, over the past 13 years, federal government health spending increased 7.5% per year from “only” $743B.”

How employer-sponsored plans are responding

Migration of employer-sponsored plans to self-insure coverage, “done right”: Health Reform did prompt many employers to self-insure their coverage to avoid certain insurance taxes, state benefit mandates, insurer profit margins and the other requirements typically part of traditional, fully insured plans. Self-insured coverage also offers a greater level of flexibility – employers can tailor the plan to meet their employees’ needs. Self-insured plans can also benefit from the most effective cost management strategies such as direct contracting, price transparency through reference-based pricing, and effectively designed HSA-capable coverage.

Direct contracting presents a cost containment opportunity: Self-funded employer-sponsored health plans are discovering that “going direct” lowers costs by eliminating the “middleman.” Superior results are achievable via a direct contracting arrangement where the plan sponsor and the health provider align their respective business interests by aligning their respective economic interests.

Adopting “pure” reference-based pricing: Adoption of a “pure” reference-based pricing (RBP) plan design enhances price transparency. A “pure” RBP structure, coupled with tech-driven data support, may avoid unreasonable or excessive provider charges – lowering both the cost of coverage and employee-paid out-of-pocket costs.

“Health and wealth” strategy via health savings accounts: HSAs offer a strategic option to alleviate “financial fragility”. HSA assets receive America’s most valuable benefits tax preference since contributions are pre-tax for federal income tax purposes, as well as most state income taxes FICA (Social Security) and FICA-MED (Medicare). Earnings accumulate tax deferred and payouts for eligible medical expenses that are tax free. Tax-preferred HSA assets are capable of “Quadruple Duty” – covering out-of-pocket costs in current and future years and Medicare premiums, while also providing for retirement income and survivor benefits.

With the right planning, preparation and plan design, employers can ensure their health plans are adequately covered and their employees can receive the accessible and affordable healthcare they need.

Harnessing technology and powerful data

A quality health plan should provide easy, direct access and understanding of pricing, benefits and out-of-pocket expense information so plan participants can make informed and cost-effective decisions. Valuable data insights are gained through innovative software and tech-driven data analysis solutions. Employers should evaluate the data they receive from the health plan, including claims data and utilization reports, to better understand which services are being used, which providers are most cost-effective, and where savings can be identified and realized.

A tech-driven approach can provide participants with insights and tools to better manage their health care costs. Harnessing technology to understand the vast amount of data can identify potential areas of escalating health costs and identify opportunities to control health costs. Innovative medical billing services utilize powerful data-driven software and online data analytic tools that can provide a degree of price transparency by harnessing price data electronically – allowing fee comparisons that identity fair and reasonable prices.

Value of a medical billing partner

The right medical billing partner facilitates all the strategic designs and processes – acting as an agent of change, embracing technology innovation and advocating for “what is fair and just.” The right partner will also provide value-added services through turnkey solutions, innovative plan designs, administrative and compliance support, as well as participant legal representation. This support provides invaluable guidance to navigate federal and state healthcare regulations, identify areas to lower risk, reduce costs, and maximize value.

About The Authors: Christine Cooper is the CEO of aequum LLC and the Co-Managing Member of Koehler Fitzgerald LLC, a law firm with a national practice. Christine leads the firm’s health care practice and is dedicated to assisting and defending plans and patients. For more information visit www.aequumhealth.com.

Jack Towarnicky is a member of aequum LLC. As an ERISA/Employee Benefits compliance and planning attorney, Jack has over forty years of experience in human resources and plan sponsor leadership roles.

Health Reform, also known as the Affordable Care Act (ACA), is the government’s approach to access to health coverage. Enacted in March 2010, the ACA’s primary intent remains one of using federal and state mandates to make health insurance coverage affordable and available for individuals. It was not designed to reduce the cost of employer-sponsored coverage for employers, or employees.

Most Americans heard many predictions about how the “Affordable Care Act” would improve health coverage, including:

• If you like your doctor, you can keep your doctor

• If you like your health plan, you can keep your health plan

• The cost of coverage for a family will decline by $2,500 a year

• Health Reform won’t add one thin dime to the deficit

More about those promises later.

Most Americans never knew that Health Reform’s #1 goal wasn’t any of the above. In actuality, Health Reform’s #1 goal was always to reduce the number of uninsured.

Health Reform accomplished that goal by expanding access to taxpayer-subsidized coverage through expanded eligibility for taxpayer-paid Medicaid coverage and taxpayer-subsidized marketplace/exchange coverage. Having someone else pay the cost of health coverage became a deal many lower income Americans couldn’t refuse. The percentage of non-elderly Americans who are uninsured has declined from 18.2% (48.2 million) in 2010, to 7% (~28 million) in 2023. Medicaid enrollment increased 3.8% per year (68%) from 54MM (2010) to 88+MM (2022) due to Health Reform’s liberalized access and the COVID response.

Health Reform also added taxpayer-subsidized public exchange coverage where enrollment grew from 0 to 14+MM. Of that 14+MM, ~90% receive taxpayer subsidies. In other words, the cost of marketplace/exchange coverage continues to be unaffordable for most Americans who do not qualify for taxpayer subsidies.

Not as predicted: A decade later: Inflation and recession challenge affordable healthcare

When it comes to employer-sponsored coverage, Health Reform’s #1 goal was to mandate certain, mostly smaller employers offer coverage, and to improve the coverage all employers offered – no matter who got stuck with the increased costs. Since 2015, employers with 50+ employees are required to offer “affordable”, “minimum essential coverage” of “minimum value” or pay a penalty tax. Since 2010, employer-sponsored coverage must cover children up to age 26 regardless of dependency. And employer-sponsored coverage can no longer limit liability using annual or lifetime benefit maximums.

Because of the recent surge in general inflation, Americans are now paying more for healthcare coverage and services than ever before. And, because wages haven’t kept up with inflation, many have become “financially fragile” – unprepared for regular expenses, let alone out-of-pocket medical costs. The economic slowdown, and looming potential recession, is also forcing employers to pare back on benefits before restoring to layoffs and terminations.

As healthcare inflation continues in 2023, medical providers are increasing their fees to maintain revenues. This financially affects most employers and plan participants who can expect to pay more for provider services and health coverage, as well as paying for the subsidy of other’s healthcare coverage through the Health Insurance Marketplace.

As all stakeholders, including patients, providers and payers, are looking towards “what’s next,” many are encountering volatile economic conditions, labor issues, and government health policies to sustain cost-effective health coverage, despite the mechanisms of Health Reform.

Ordinarily, the past is not a good predictor of the future. However, when it comes to employer-sponsored health coverage, the future, “what’s next”, looks like a repeat of the past, if not worse. Consider the following chart – it shows that costs have increased at a greater rate since 2010 – when Health Reform became law:

Data from the annual Kaiser survey shows that, during the twelve years after Health Reform worker contributions for single coverage have increased 3.3% per year while family coverage costs increased 3.6% per year. For comparison, employer-paid costs increased 4% per year, single and 4.4% per year, family.

This data shows that employers continue to shoulder more of the burden of health care inflation.

The average costs for U.S. employers that pay for their employees' healthcare now exceeds $13,800 per employee, according to professional services firm Aon. Aon and other benefit consulting firms project a future of ever-increasing rates for those covered under employer-sponsored plans.

We have yet to see the full impact of recent inflation on health care prices. How those increases, and continued deficit spending, will ripple through the economy is unknowable at this time. Suffice to say that health care costs will not decline in 2024.

Not as predicted: The future of employer-sponsored coverage after health reform

Long ago, two of the architects of Health Reform predicted that employer-sponsored health coverage would decline significantly by 2025 (two years from now):

• “By 2025, few private-sector employers will still be providing health insurance,” declares Ezekiel J. Emanuel, author of Reinventing American Health Care (Public Affairs, 2014) and advisor to the Obama administration during the drafting of the ACA.

• “The very likely prediction over the near term is that slight erosion continues in employer-sponsored insurance, over a longer term—say, a 25- to 50-year horizon—only the biggest employers may be still in the game.” says Jonathan Gruber, Massachusetts Institute of Technology economics professor who helped craft the ACA.

However, like the other predictions (keep your doctor, keep your plan, reduce costs, avoid deficit spending), the experts and proponents of Health Reform have been wrong. Employer-sponsored health benefits have persisted.

A study by the Employee Benefit Research Institute (EBRI) and the Commonwealth Fund, What Employers Say About the Future of Employer-Sponsored Health Insurance, identifies the conditions that might lead employers to stop providing health benefits. Study findings revealed that employers often view themselves as paternalistic: they wish to make it easier for their workers to get affordable health coverage. Accordingly, those interviewed found it difficult to imagine future circumstances that would lead their companies to stop providing health coverage. However, should we see additional policy initiatives, such as the extension of ACA subsidies and the provision of a public option, employers may reconsider their practice of offering health benefits to their workers.

Not as predicted: Health reform impacts annual deficits and national debt

Since the passage of Health Reform, annual deficits have added $19T+ to the national debt. America is now $31T+ in debt, in addition to significant underfunding of entitlements like Social Security and Medicare. We know of no estimate that isolated the impact of Health Reform on annual deficits and additions to the national debt. However, post-pandemic, federal government health care spending is now $1.9T a year, almost $1 of every $3 of federal spending. For comparison, over the past 13 years, federal government health spending increased 7.5% per year from “only” $743B.”

How employer-sponsored plans are responding

Migration of employer-sponsored plans to self-insure coverage, “done right”: Health Reform did prompt many employers to self-insure their coverage to avoid certain insurance taxes, state benefit mandates, insurer profit margins and the other requirements typically part of traditional, fully insured plans. Self-insured coverage also offers a greater level of flexibility – employers can tailor the plan to meet their employees’ needs. Self-insured plans can also benefit from the most effective cost management strategies such as direct contracting, price transparency through reference-based pricing, and effectively designed HSA-capable coverage.

Direct contracting presents a cost containment opportunity: Self-funded employer-sponsored health plans are discovering that “going direct” lowers costs by eliminating the “middleman.” Superior results are achievable via a direct contracting arrangement where the plan sponsor and the health provider align their respective business interests by aligning their respective economic interests.

Adopting “pure” reference-based pricing: Adoption of a “pure” reference-based pricing (RBP) plan design enhances price transparency. A “pure” RBP structure, coupled with tech-driven data support, may avoid unreasonable or excessive provider charges – lowering both the cost of coverage and employee-paid out-of-pocket costs.

“Health and wealth” strategy via health savings accounts: HSAs offer a strategic option to alleviate “financial fragility”. HSA assets receive America’s most valuable benefits tax preference since contributions are pre-tax for federal income tax purposes, as well as most state income taxes FICA (Social Security) and FICA-MED (Medicare). Earnings accumulate tax deferred and payouts for eligible medical expenses that are tax free. Tax-preferred HSA assets are capable of “Quadruple Duty” – covering out-of-pocket costs in current and future years and Medicare premiums, while also providing for retirement income and survivor benefits.

With the right planning, preparation and plan design, employers can ensure their health plans are adequately covered and their employees can receive the accessible and affordable healthcare they need.

Harnessing technology and powerful data

A quality health plan should provide easy, direct access and understanding of pricing, benefits and out-of-pocket expense information so plan participants can make informed and cost-effective decisions. Valuable data insights are gained through innovative software and tech-driven data analysis solutions. Employers should evaluate the data they receive from the health plan, including claims data and utilization reports, to better understand which services are being used, which providers are most cost-effective, and where savings can be identified and realized.

A tech-driven approach can provide participants with insights and tools to better manage their health care costs. Harnessing technology to understand the vast amount of data can identify potential areas of escalating health costs and identify opportunities to control health costs. Innovative medical billing services utilize powerful data-driven software and online data analytic tools that can provide a degree of price transparency by harnessing price data electronically – allowing fee comparisons that identity fair and reasonable prices.

Value of a medical billing partner

The right medical billing partner facilitates all the strategic designs and processes – acting as an agent of change, embracing technology innovation and advocating for “what is fair and just.” The right partner will also provide value-added services through turnkey solutions, innovative plan designs, administrative and compliance support, as well as participant legal representation. This support provides invaluable guidance to navigate federal and state healthcare regulations, identify areas to lower risk, reduce costs, and maximize value.

About The Authors: Christine Cooper is the CEO of aequum LLC and the Co-Managing Member of Koehler Fitzgerald LLC, a law firm with a national practice. Christine leads the firm’s health care practice and is dedicated to assisting and defending plans and patients. For more information visit www.aequumhealth.com.

Jack Towarnicky is a member of aequum LLC. As an ERISA/Employee Benefits compliance and planning attorney, Jack has over forty years of experience in human resources and plan sponsor leadership roles.