World ultrasound market to return to growth in 2023

September 22, 2023

By Mustafa Hassan

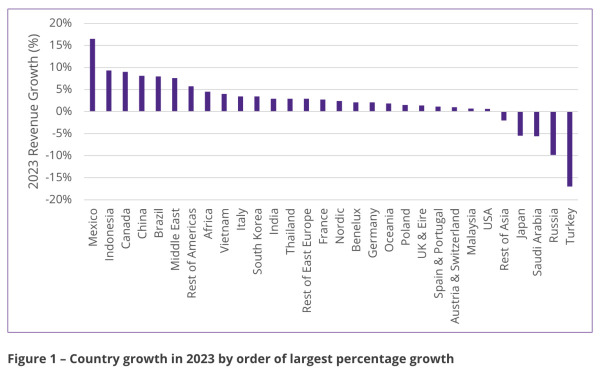

The ultrasound market is forecast to recover in 2023 from the supply chain and macroeconomic issues that impacted the market in 2022. Vendors now have better control of their supply chains and are starting to address their order backlogs. The recovery will be boosted by new product releases in the last 12 months driving increased demand. These macro-influences also impacted regional markets to varying degrees — our roundup of the main geographical market changes is outlined below.

Western Europe – Growth in local currency, but a market decline in USD

Despite supply chain challenges, the energy crisis and rising inflation in 2022, the Western European ultrasound market is estimated to have grown in local currency terms. However, when looking at the market in USD, it is estimated to have declined.

Several Western European countries are looking to improve the quality of healthcare offered, supporting a more positive outlook near-term and helping limit declines in most markets in 2022. The Italian government has allocated €125 billion to the national health system, France has an initiative to create a more integrated health system, the Ma Santé 2022 strategy, which is supported by €3.4 billion of government funding. The U.K. government has pledged to allocate £2.3 billion to an initiative aimed at increasing diagnostic services capacity in the NHS and clearing the backlog of scans from the COVID pandemic.

The EU framework change from MDD (Medical Devices Directive) to MDR (Medical Device Regulation) has caused a headache for vendors, creating a backlog in obtaining commercial approval for new products in the EU, with delays of around 6 months. This has had the biggest impact on smaller vendors, some of whom may be trying to release their first product.

Eastern Europe, Middle East and Africa: Russia market propped up by Chinese vendors

The Eastern European market was estimated to have declined in 2022, driven by the heavy decline in the Russian market because of the sanctions imposed after its invasion of Ukraine. However, the decline in Russia was not as high as initially estimated, with the loss of business from Western vendors partially offset by increased sales to Chinese vendors. Elsewhere, the reduction of EU funding has slowed market growth in other Eastern European countries, starting from the second half of 2022.

Chinese vendors are increasingly focusing on the European market and are looking to enter via Eastern European markets, before moving west. The more price-sensitive nature of the Eastern European market, as well as the ability for Chinese vendors to deliver systems quickly during the recent periods of supply chain problems, has seen them increase their market share in 2022 and should lead to further market share gains in 2023.

The MEA was the fastest growing region in 2022 with the African, Middle East, Saudi Arabian and markets all estimated to have grown. Fastest growth was estimated in Saudi Arabia, primarily due to new greenfield private sector projects alongside government-funded NUPCO tenders. The large 809-unit tender announced in Turkey in 2021 led to market growth in both 2021 and 2022. In Africa, growth was driven by strong market performance in Egypt, with its Haya Karima initiative, as well as strong growth in South Africa, after 2 years of market decline.

North America – Market slowdown expected to continue into 2023

The U.S. market experienced strong growth in the first half of 2022, where the market continued to be boosted by the increased investment seen in 2021, before the market slowed down in the second half of 2022. This slowdown is still being observed in 2023, in part, due to some customers delaying orders.

In March 2023, the FDA finalized a regulation that requires that all women receive information about their breast density following a mammogram. The new regulation goes into effect in September 2024. This is expected to increase the number of breast ultrasound scans performed, which along with MR, is more effective for imaging dense breasts.

The Canadian market went through a correctional decline in 2022, after large growth in 2021. The market is forecast to return to growth in 2023.

Latin America – Becoming more price conscious

The LATAM ultrasound market experienced strong growth in 2022, mainly driven by strong growth in Mexico. There is a growing trend in LATAM of customers trying new brands that offer lower-priced ultrasound systems. This trend is mainly seen in the radiology market and is less evident in the cardiology and women’s health segments, where the final decision is typically based on clinical features of the ultrasound system and not its price.

Ultrasound prices in LATAM increased in 2022, especially from established vendors. With Chinese vendors becoming more active in the market and not increasing their system prices as aggressively, it accelerated the trend of customers trying new brands.

China: Domestic vendors benefitting from government policies

With the country in lockdown for most of 2022, and only fully reopening in Q4 2022, alongside currency fluctuations, market growth was hindered (in dollar terms) in 2022.

Domestic Chinese vendors performed strongest in 2022, boosted by the local manufacturing policy implemented in 2021. The impact on international vendors varied, depending on how successful they have been in obtaining local production certification. This policy was strengthened in early 2023, with the local content requirement increasing from 63% to 85%.

The expansion of healthcare into rural areas is expected to drive growth during the forecast period. However, the slowing Chinese economy will impact long term growth prospects for the ultrasound market.

Japan: Market decline to continue into 2023

After strong growth in 2021, driven by the large supplemental budget designed to finance the government’s economic stimulus package, the market was estimated to have declined in 2022. The biggest declines in 2022 were estimated to be in the radiology, cardiology and point-of-care markets. A further decline is forecast for 2023 due to the continued effect of the reduced supplemental budget, as well as rising prices and staff wages.

Price increases varied in Japan in 2022, with some vendors keeping prices the same and others raising prices by around 10%. Whilst some vendors may want to increase prices again in 2023, further price rises will be hard to justify as other vendors haven’t increased prices at all.

There is a government funded National healthcare transformation due to start in 2024, which will include purchasing of ultrasound systems. Subregional government and hospitals are currently deciding where the funding should be spent.

Southeast Asia: Growth forecast for all markets

All other markets in Asia were estimated to have grown in 2022. The Indian market is estimated to have had another year of strong growth driven by demand in the primary care, radiology and women’s health markets and the continued trend of patients seeking healthcare locally, resulting in more clinics opening.

There was strong growth again in the Oceania market, which also saw strong growth in 2020 and 2021, driven by new ultrasound users in the handheld and point-of-care segments. Elsewhere, strong growth in Indonesia was driven by additional funding for primary care, and strong growth in Malaysia was driven by its recovery from the corruption scandal in 2021.

Countries are increasingly adopting local production policies, with the policies varying in how they are enforced. Whilst the Indian government continues to push for local manufacturing of medical devices, their main objective is to increase investment into the country. The Indonesian government spent its recent budget for primary care on locally produced products, requiring a minimum of 25% of the system to be locally made. This 25% is only for primary care but will most likely be rolled out to other clinical segments. The percentage is also likely to increase in the coming years.

The Signify View

Whilst market growth in 2023 will continue to be hampered by the current macroeconomic climate, the longer-term outlook is more positive. Several governments are looking to improve healthcare in their countries, with China and India the most prominent examples. There have been several new product releases in the last year from major vendors across all clinical applications and these are expected to drive growth in the short term. Pricing will also be key, especially in adapting prices in each market as inflationary pressures ease at different rates and competition intensifies. This will be crucial in emerging growth markets targeted by Asia Pacific vendors looking to expand into Western markets, combined with recent forex changes, such as the weakening of the Japanese yen against the USD.

About the author: Mustafa Hassan is a senior market analyst at Signify Research. He is part of the Medical Imaging team which covers areas such as ultrasound, general radiography and machine learning in medical imaging. Signify Research provides healthtech market intelligence powered by data. The company blends insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported by leading vendors to provide a complete and balanced view of the market trends.

The ultrasound market is forecast to recover in 2023 from the supply chain and macroeconomic issues that impacted the market in 2022. Vendors now have better control of their supply chains and are starting to address their order backlogs. The recovery will be boosted by new product releases in the last 12 months driving increased demand. These macro-influences also impacted regional markets to varying degrees — our roundup of the main geographical market changes is outlined below.

Western Europe – Growth in local currency, but a market decline in USD

Despite supply chain challenges, the energy crisis and rising inflation in 2022, the Western European ultrasound market is estimated to have grown in local currency terms. However, when looking at the market in USD, it is estimated to have declined.

Several Western European countries are looking to improve the quality of healthcare offered, supporting a more positive outlook near-term and helping limit declines in most markets in 2022. The Italian government has allocated €125 billion to the national health system, France has an initiative to create a more integrated health system, the Ma Santé 2022 strategy, which is supported by €3.4 billion of government funding. The U.K. government has pledged to allocate £2.3 billion to an initiative aimed at increasing diagnostic services capacity in the NHS and clearing the backlog of scans from the COVID pandemic.

The EU framework change from MDD (Medical Devices Directive) to MDR (Medical Device Regulation) has caused a headache for vendors, creating a backlog in obtaining commercial approval for new products in the EU, with delays of around 6 months. This has had the biggest impact on smaller vendors, some of whom may be trying to release their first product.

Eastern Europe, Middle East and Africa: Russia market propped up by Chinese vendors

The Eastern European market was estimated to have declined in 2022, driven by the heavy decline in the Russian market because of the sanctions imposed after its invasion of Ukraine. However, the decline in Russia was not as high as initially estimated, with the loss of business from Western vendors partially offset by increased sales to Chinese vendors. Elsewhere, the reduction of EU funding has slowed market growth in other Eastern European countries, starting from the second half of 2022.

Chinese vendors are increasingly focusing on the European market and are looking to enter via Eastern European markets, before moving west. The more price-sensitive nature of the Eastern European market, as well as the ability for Chinese vendors to deliver systems quickly during the recent periods of supply chain problems, has seen them increase their market share in 2022 and should lead to further market share gains in 2023.

The MEA was the fastest growing region in 2022 with the African, Middle East, Saudi Arabian and markets all estimated to have grown. Fastest growth was estimated in Saudi Arabia, primarily due to new greenfield private sector projects alongside government-funded NUPCO tenders. The large 809-unit tender announced in Turkey in 2021 led to market growth in both 2021 and 2022. In Africa, growth was driven by strong market performance in Egypt, with its Haya Karima initiative, as well as strong growth in South Africa, after 2 years of market decline.

North America – Market slowdown expected to continue into 2023

The U.S. market experienced strong growth in the first half of 2022, where the market continued to be boosted by the increased investment seen in 2021, before the market slowed down in the second half of 2022. This slowdown is still being observed in 2023, in part, due to some customers delaying orders.

In March 2023, the FDA finalized a regulation that requires that all women receive information about their breast density following a mammogram. The new regulation goes into effect in September 2024. This is expected to increase the number of breast ultrasound scans performed, which along with MR, is more effective for imaging dense breasts.

The Canadian market went through a correctional decline in 2022, after large growth in 2021. The market is forecast to return to growth in 2023.

Latin America – Becoming more price conscious

The LATAM ultrasound market experienced strong growth in 2022, mainly driven by strong growth in Mexico. There is a growing trend in LATAM of customers trying new brands that offer lower-priced ultrasound systems. This trend is mainly seen in the radiology market and is less evident in the cardiology and women’s health segments, where the final decision is typically based on clinical features of the ultrasound system and not its price.

Ultrasound prices in LATAM increased in 2022, especially from established vendors. With Chinese vendors becoming more active in the market and not increasing their system prices as aggressively, it accelerated the trend of customers trying new brands.

China: Domestic vendors benefitting from government policies

With the country in lockdown for most of 2022, and only fully reopening in Q4 2022, alongside currency fluctuations, market growth was hindered (in dollar terms) in 2022.

Domestic Chinese vendors performed strongest in 2022, boosted by the local manufacturing policy implemented in 2021. The impact on international vendors varied, depending on how successful they have been in obtaining local production certification. This policy was strengthened in early 2023, with the local content requirement increasing from 63% to 85%.

The expansion of healthcare into rural areas is expected to drive growth during the forecast period. However, the slowing Chinese economy will impact long term growth prospects for the ultrasound market.

Japan: Market decline to continue into 2023

After strong growth in 2021, driven by the large supplemental budget designed to finance the government’s economic stimulus package, the market was estimated to have declined in 2022. The biggest declines in 2022 were estimated to be in the radiology, cardiology and point-of-care markets. A further decline is forecast for 2023 due to the continued effect of the reduced supplemental budget, as well as rising prices and staff wages.

Price increases varied in Japan in 2022, with some vendors keeping prices the same and others raising prices by around 10%. Whilst some vendors may want to increase prices again in 2023, further price rises will be hard to justify as other vendors haven’t increased prices at all.

There is a government funded National healthcare transformation due to start in 2024, which will include purchasing of ultrasound systems. Subregional government and hospitals are currently deciding where the funding should be spent.

Southeast Asia: Growth forecast for all markets

All other markets in Asia were estimated to have grown in 2022. The Indian market is estimated to have had another year of strong growth driven by demand in the primary care, radiology and women’s health markets and the continued trend of patients seeking healthcare locally, resulting in more clinics opening.

There was strong growth again in the Oceania market, which also saw strong growth in 2020 and 2021, driven by new ultrasound users in the handheld and point-of-care segments. Elsewhere, strong growth in Indonesia was driven by additional funding for primary care, and strong growth in Malaysia was driven by its recovery from the corruption scandal in 2021.

Countries are increasingly adopting local production policies, with the policies varying in how they are enforced. Whilst the Indian government continues to push for local manufacturing of medical devices, their main objective is to increase investment into the country. The Indonesian government spent its recent budget for primary care on locally produced products, requiring a minimum of 25% of the system to be locally made. This 25% is only for primary care but will most likely be rolled out to other clinical segments. The percentage is also likely to increase in the coming years.

The Signify View

Whilst market growth in 2023 will continue to be hampered by the current macroeconomic climate, the longer-term outlook is more positive. Several governments are looking to improve healthcare in their countries, with China and India the most prominent examples. There have been several new product releases in the last year from major vendors across all clinical applications and these are expected to drive growth in the short term. Pricing will also be key, especially in adapting prices in each market as inflationary pressures ease at different rates and competition intensifies. This will be crucial in emerging growth markets targeted by Asia Pacific vendors looking to expand into Western markets, combined with recent forex changes, such as the weakening of the Japanese yen against the USD.

About the author: Mustafa Hassan is a senior market analyst at Signify Research. He is part of the Medical Imaging team which covers areas such as ultrasound, general radiography and machine learning in medical imaging. Signify Research provides healthtech market intelligence powered by data. The company blends insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported by leading vendors to provide a complete and balanced view of the market trends.